Graduates from the Applied Mathematics (Financial Engineering and Risk Management) program will be expected to:

- (PO1) Apply effectively their knowledge and skills as financial engineers within the industry as well as the state agencies dealing with the analysis and design of modern financial products and processes

- (PO2) Work and communicate effectively with others on multi-disciplinary teams to develop practical, technically sound, cost-effective solutions to complex financial problems

- (PO3) Maintain an active program of lifelong learning, self-updating, and continuing education while practicing financial engineering in an ethical and professionally responsible manner

- (PO4) Understand professional, ethical, legal, security, and social issues and responsibilities. Seek leadership roles as practitioners and become active members of professional and technical societies.

Program Learning Outcomes (PLO or ELO)

The Expected Learning Outcomes (ELOs) of the program, also known as the program learning outcome (PLO) are formulated as below. Upon graduation, our students should be able to:

(a) Apply their modern knowledge in mathematics, modeling, and simulations in order to compute a concrete problem in finance, risk management, and related fields appropriately.

(b) Interpret the mathematical approaches and model selections for solving a specific problem in applied mathematics, finance, and risk management efficiently.

(c) Design experiments using reasoning, creative thinking, and mathematical models.

(d) Evaluate a financial product or risk management strategy to meet desired needs and constraints, such as economic, environmental, social, political, ethical, health and safety, manufacturability, and sustainability.

(e) Perform effectively on multidisciplinary teams to accomplish a common goal.

(f) Display the ability to communicate effectively with a broad range of audiences in both academic and industrial communities.

(g) Adhere to professional, ethical, legal, security, and social issues and responsibilities.

(h) Build their integrating knowledge of contemporary issues.

(i) Form a scientific worldview, logical and independent thinking to build a stable ideology and to follow the state policies.

(j) Adapt the broad educational foundation to flexibly adjust applied mathematics solutions to a specific global, economic, environmental, and societal problem in the uncertain real world.

(k) Formulate the need and continue their professional development and lifelong learning.

Program Specification

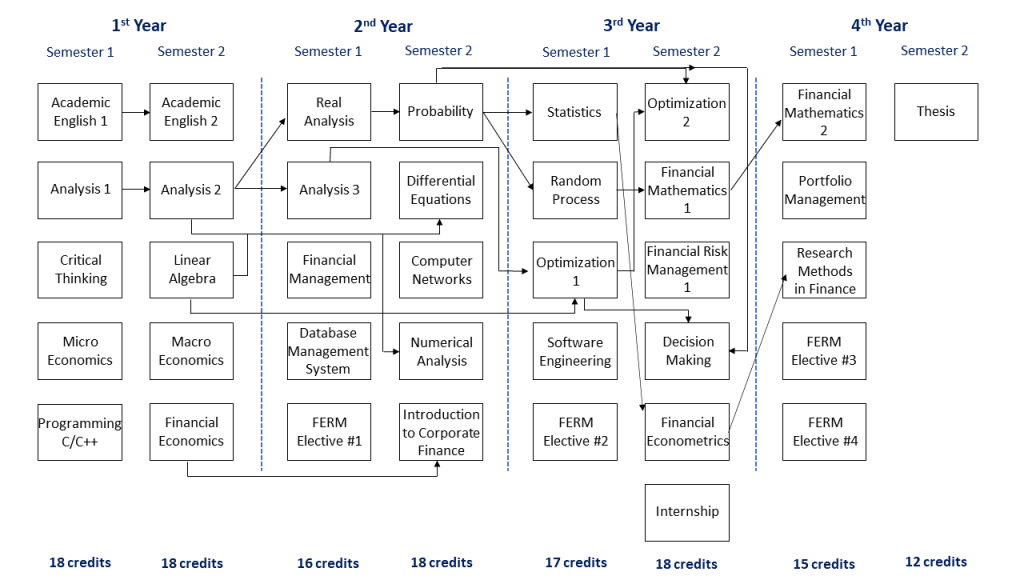

Program specification_FERMCurriculum map (K2020 and backward)

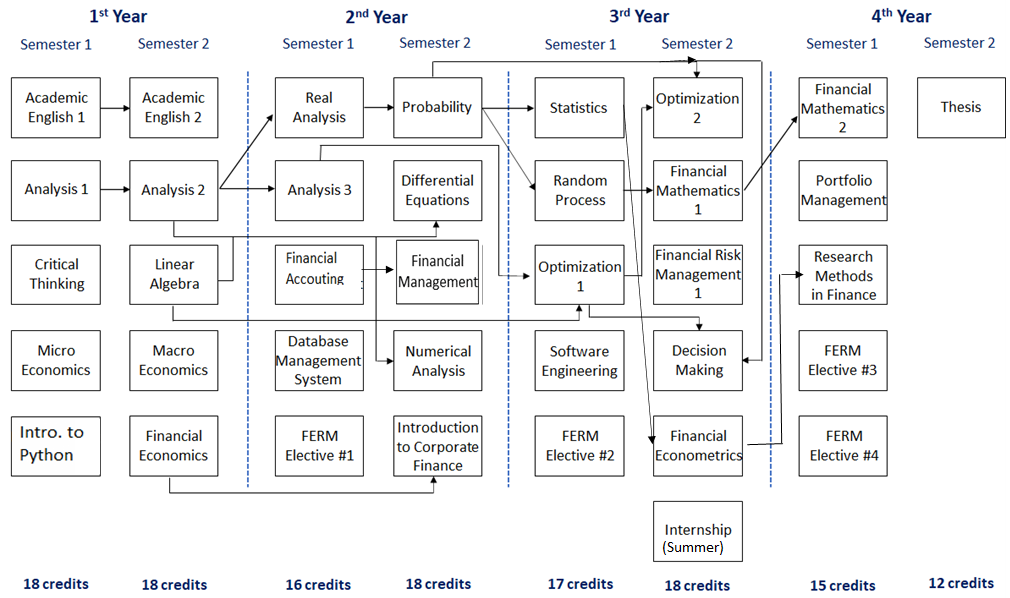

Curriculum map (from K2021 and forward)

Elective courses:

FERM Elective #1: MAFE209IU- Financial markets; MAFE210IU- Functional analysis; MAFE211IU- Web application programming.

FERM Elective #2: MAFE310IU-Modeling and simulation; MAFE311IU-Asset pricing; MAFE312IU-Data mining.

FERM Elective #3: MAFE404IU-Financial Risk Management 2; MAFE411IU-Introduction to Operations research; MAFE406IU-Parallel computing.

FERM Elective #4: MAFE407IU-Mathematical economics; MAFE410IU-Exchange rates and international finance; BA306AF/BA190IU Financial statement analysis and business evaluation